Important Changes to CREO PROGRAM this Final Year

As we head into the third and final year of the Open for Business program, we have learned a lot about what it takes to launch financial products that are truly successful in serving small business owners.

Our most innovative product, Collective Real Estate Ownership (CREO), offers a great opportunity. It provides up to $500,000 in a forgivable loan towards the down payment to purchase commercial real estate in a shared ownership model.

The benefits of owning commercial real estate to reduce the racial wealth gap and impacts of collective ownership have been covered substantially elsewhere. However, for first-time commercial buyers and many minority business owners, there can be large hurdles to doing this successfully.

To ensure we best support recipients, we regularly revisit program guidelines and requirements to make sure that owners succeed in their transactions. Read on for important CREO program updates to expect in 2024.

Update #1: New eligible communities.

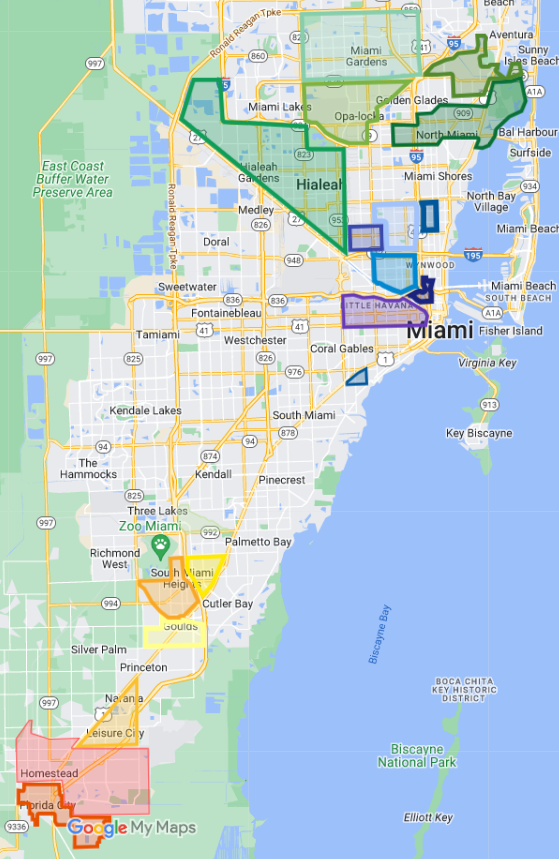

The objective of CREO is to foster investment and ownership in areas that have been historically overlooked. As a result, we identify key communities that are eligible for the program. We also regularly listen to community feedback about which areas are included to make enhancements in future rounds. We are pleased to share that 4 new communities are being added in 2024:

- Hialeah and Little Havana

- Goulds and South Miami Heights

Both past and future CREO collaboratives can look for property in

these areas. Check out our updated Google Map for more details.

Update #2: Require new details to ensure the strength of your collaborative.

Because CREO applicants are jointly purchasing property, it’s important that they clearly understand their business terms before applying to the program. Many collaboratives have only discussed these terms in passing, but it’s important to put them down on paper.

Moving forward, we will require CREO applicants to:

- Align on % equity split and business terms in advance. This means that all organizations in the business roster must have a clear % of equity split. You will also want to determine who is a proposed co-owner and who is a tenant/lessee.

- Submit a draft operating agreement. In almost all cases, CREO collectives will form a new joint venture to hold title to the property and this entity will have distinct operating protocols. For example, who are the members? How often will they meet? What decisions are they allowed to make? What decisions require unanimous agreement? What happens if one of the owners exit?

- These questions and more are answered in a legal document called an operating agreement. You will now need to submit a draft copy of this document as part of your CREO application.

- While we can’t provide you with a template, we do have a list of questions to consider when drafting your business terms and OA in the Templates section of our website.

- If you need legal resources to develop this draft, we suggest reaching out to Legal Services of Greater Miami.

Update #3: More deeply assess financial capacity to prepare for senior financing.

Lastly, we want to make sure CREO applicants are fully prepared to secure financing for the remainder of the property. While CREO provides up to 20% of the purchase price, applicants will need to find an outside lender to finalize their capital stack.

What we’ve learned is that senior lenders will ask CREO collaboratives for many of these same financial documents, so we will begin to ask for them upfront so that applicants are not caught off guard later in the process.

- Tax returns: We will ask for 2 years of tax statements (990 for nonprofits) in lieu of 1 year to have a longer-term view of your business.

- Income or profit & loss statement: This view of your finances helps assess all your incoming revenue, outgoing expenses, and whether you are running a surplus or a deficit. It is often a retrospective look at your company’s financial performance. This is different from a budget, which attempts to forecast your income & expenses in a future or current year.

- Pro forma for operating the property: While many collaboratives plan for the monthly mortgage payment (principal + insurance), they may not realize the other costs associated with operating the property. For example, taxes, property insurance, maintenance, lawn & pest, and more. A pro forma (projection or hypothetical) property operating budget will be required.

We recognize that completing these financial documents can feel daunting. To help, we have created optional templates on our website – but if you have your own documents, you are not required to use them. You must still complete the required CREO project budget template. We also encourage you to reach out to one of our technical assistance (TA) business support organizations that can help you complete these documents.

We look forward to reviewing this year’s round of CREO applications. Don’t miss out on the webinar co-hosted with Axis Helps on Thursday, January 18 th from 1-2pm. Please contact us if you have any other questions.