Small Business Policy: Our Work

We’ve heard your feedback about going beyond Open for Business funding.

Miami Open for Business (OFB) is a three-year initiative funded by Wells Fargo and led by The Miami Foundation to support small, historically underserved business owners to own assets, such as property, equipment, and technology. In the program’s first two years, we’ve distributed more than $11 million to over 300 small businesses and technical assistance organizations. We’ve seen that acquiring tangible assets is critical to supporting small businesses to grow.

These figures are notable, but there is more work to be done. In designing this program, we heard from community stakeholders that access to funding for asset ownership is critical. At the same time, we also heard that advocacy and policy efforts are vital to create far-reaching impacts for all small business owners.

Pictured: Ultina Harris, Creator of Suite 110 Urbanwear in Overtown, Miami, FL with Maria Coto, Executive Director of CDFI Partners for Self Employment.

We know that systemic conditions can prevent small business owners from thriving.

Small businesses are the backbone of our local economy, creating jobs, providing unique products, and benefiting the community at large. Research shows that neighborhoods with more small businesses contribute more in taxes and help people feel more connected to each other (Institute for Local Self Reliance).

However, small businesses face significant challenges being able to reach their full potential due to various systemic barriers. These challenges include:

- Misguided policies: Local, state and federal agencies have historically and sometimes inadvertently created policies that make it difficult for small businesses to live up to their potential.

- Confusing legal and regulatory barriers: Being able to maneuver through the processes for sustaining a business, such as fees, licensing, and requirements.

- Speculative real estate market: Market conditions beyond the control of business owners that make renting unaffordable and small businesses can’t stay local and rooted in their communities.

- Limited access to financing: Not being able to get traditional bank loans or access to informal capital, like “friends & family” support.

We know these barriers are not experienced equally. Business owners of color and immigrant-owned businesses report more discrimination in lending, are more likely to be exploited by landlords, and are particularly vulnerable to economic downturns. (Small Business Anti-Displacement Network). This is often because, as compared to their peers, minority and immigrant businesses have less bargaining power, smaller resource networks, and face unique language barriers.

At The Miami Foundation, we believe that small businesses deserve to be protected, adequately resourced, and prioritized. Their positive impact on the economy and our overall community is crucial to creating a Greater Miami where everyone can thrive.

So, we launched a policy program and research project to support Miami business owners.

We must go beyond programs to alter our public policies and protect Miami’s local entrepreneurs. To that end, the Miami Open for Business Program is launching an advocacy and policy agenda research project.

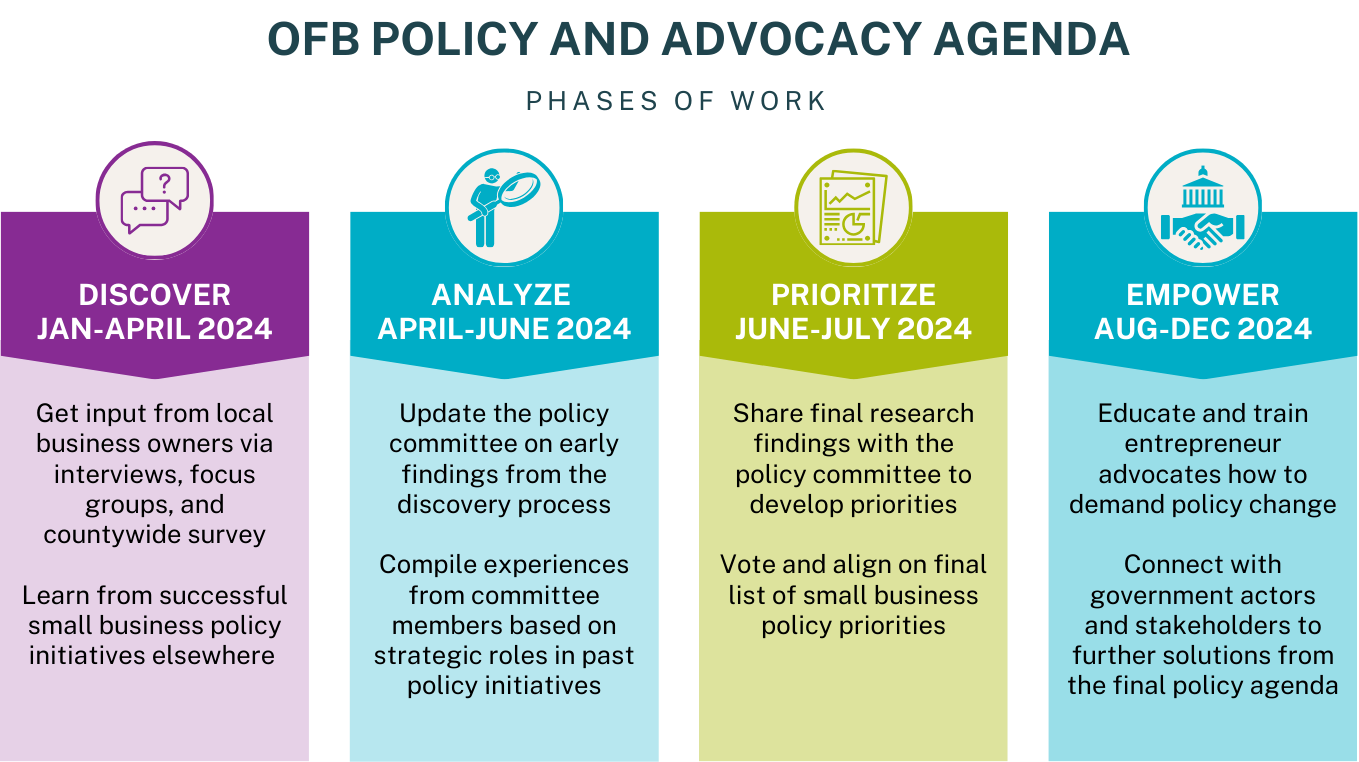

To deliver this project, we have joined forces with Catalyst Miami, Miami Worker’s Center, Weiss Serota, and a committee of small business stakeholders to speak with entrepreneurs and ensure that our policy agenda is aligned with the actual needs of small business owners in Miami. Below is our process.

The goal of the Open for Business policy initiative is to identify protective measures that best support underserved small businesses so that they can remain competitive and locally rooted in Miami’s economy.

Policy Implementation Partners

Catalyst Miami

Miami Workers’ Center

Weiss Serota

Role:

Will lead on engaging business owners and summarizing local and national findings.

Role:

Will conduct advocacy and mobilization trainings for entrepreneurs to engage in local policy processes.

Role:

Will explore how to turn entrepreneurs’ desires into policy by conducting legal analysis and exploring precedence for potential ordinances or resolutions.